Ethereum Price Prediction: Why Institutional Investors Are Betting Big on ETH’s DeFi Future

#ETH

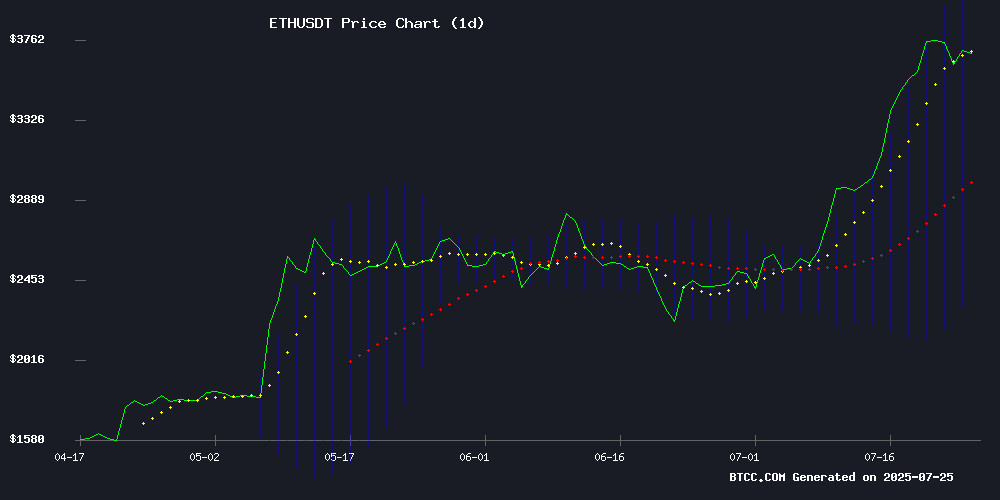

- Technical Breakout Potential: ETH testing upper Bollinger Band while maintaining 14% premium to 20MA

- Institutional Catalysts: $2B BitMine allocation and NFT market activity signaling smart money accumulation

- Regulatory Balance: Tornado Cash case creates headwinds, but DeFi infrastructure bets offset concerns

ETH Price Prediction

ETH Technical Analysis: Bullish Signals Emerge Despite Short-Term Volatility

Ethereum (ETH) is currently trading at $3,715.49, significantly above its 20-day moving average (MA) of $3,238.80, indicating strong bullish momentum. The MACD histogram remains negative (-65.6184), but the narrowing gap between the MACD line (-536.1429) and signal line (-470.5246) suggests weakening downward pressure. Bollinger Bands show price hovering NEAR the upper band ($4,089.01), signaling potential overbought conditions. According to BTCC financial analyst Ava, 'ETH's sustained position above the 20-day MA and tightening Bollinger Bands often precede breakout movements. Traders should watch for a confirmed close above $4,089 to confirm the next leg up.'

Institutional Demand and Privacy Debates Fuel Ethereum Market Sentiment

Positive catalysts dominate Ethereum's news flow: BitMine's $2B ETH treasury allocation and ARK Invest's infrastructure focus underscore institutional confidence. High-profile NFT acquisitions (GameSquare's $5.15M CryptoPunk purchase) demonstrate sustained Web3 demand. However, Ava notes mixed signals: 'While the Tornado Cash trial creates regulatory uncertainty, the market appears focused on Ethereum's institutional adoption narrative. The 4% price surge post-BitMine news shows how treasury strategies now drive ETH valuation.'

Factors Influencing ETH's Price

ARK Invest Rebalances Portfolio, Shifts Focus from Exchanges to Blockchain Infrastructure

ARK Invest, under CEO Cathie Wood's leadership, has sold approximately $13 million in Coinbase (COIN) and Robinhood (HOOD) shares. The sales included 30,501 Coinbase shares ($12 million) and 11,262 Robinhood shares ($1.1 million), executed across multiple ARK funds. This move follows a recent $116 million investment in BitMine Immersion Technologies, an Ethereum treasury solutions provider backed by Peter Thiel.

The sales signal a strategic pivot away from crypto exchange exposure toward blockchain infrastructure plays. Despite June's $12.5 million Coinbase share reduction, COIN remains ARKK's top holding at nearly 10% of the fund. ARK's earlier purchases—4,198 Coinbase shares ($1.3 million) and 319,000 Robinhood shares ($24.4 million)—appear part of a broader realignment responding to evolving crypto market dynamics and stablecoin trends.

Storm Defends Tornado Cash Role in High-Stakes Court Battle

The prosecution in the United States has wrapped up its investigation phase in the trial of Roman Storm, a developer behind the privacy-focused protocol Tornado Cash. Over eight days of witness testimonies, the court scrutinized the protocol's role and the accountability of its creators. The defense has now taken center stage, calling Ethereum Core developer Preston Van Loon as its first witness. Van Loon testified that Tornado Cash serves as a vital privacy tool, allowing users to dissociate their identities from financial transactions—a feature he personally utilized for security reasons.

Storm's legal team argues that while Tornado Cash has been misused by malicious actors, its primary function addresses legitimate privacy demands. Drawing parallels to messaging apps and VPNs, defense attorney Keri Axel emphasized the protocol's dual-use nature. The defense plans to spend three days presenting witnesses to counter the allegations against Storm. The trial highlights the ongoing tension between privacy innovation and regulatory oversight in the cryptocurrency space.

Why SpacePay Is the Top Altcoin Everyone’s Betting On This Summer

London-based startup SpacePay is addressing a long-standing pain point in crypto payments by enabling traditional card machines to accept digital currencies without hardware upgrades. The system supports 325+ wallets and charges a minimal 0.5% fee while instantly converting crypto to fiat, shielding merchants from volatility risks.

The $SPY token presale has already raised $1.2 million, with tokens currently priced at $0.003181. Unlike most blockchain projects that require ecosystem overhauls, SpacePay integrates seamlessly with existing Android payment terminals through a simple software update.

With 400 million global crypto holders currently limited in spending options, and merchants missing crypto-paying customers, SpacePay bridges this gap without forcing behavioral changes. The platform's real-time conversion ensures merchants receive exact fiat amounts regardless of subsequent crypto price fluctuations.

Tornado Cash Developer's Trial Pivots to Ethereum Privacy Debate

Prosecutors concluded their case against Tornado Cash co-founder Roman Storm after eight days of testimony in a Manhattan federal court. The defense countered with Ethereum core developer Preston Van Loon, who framed the sanctioned mixing protocol as essential privacy infrastructure for the blockchain ecosystem.

Van Loon testified to personal use of Tornado Cash for security purposes, drawing parallels to VPNs and encryption tools. The witness avoided mention of his successful legal challenge against Treasury sanctions—a topic barred by Judge Katherine Polk Failla.

Storm's legal team positions the protocol as neutral technology occasionally misused by bad actors, akin to dual-use tools like hammers. The case may set precedent for developer liability concerning open-source code with illicit applications.

U.S. Appeals Court Overturns Ruling in Yuga Labs vs. Ryder Ripps NFT Trademark Case

The 9th Circuit Court of Appeals has nullified a lower court's decision in the high-profile legal battle between Yuga Labs, creator of the Bored Ape Yacht Club (BAYC) NFTs, and artist Ryder Ripps. The appellate court ruled that Yuga Labs must provide clearer evidence to support its trademark infringement claims against Ripps' RR/BAYC collection, ordering a retrial.

Yuga Labs had originally secured an $8 million judgment against Ripps in 2022, alleging his satirical NFT collection caused consumer confusion and violated trademark rights. The appeals court found the initial ruling insufficient, reviving debates about parody protections in digital asset markets where Ethereum-based collections like BAYC command billion-dollar valuations.

The case underscores growing tensions between intellectual property rights and creative expression in Web3 ecosystems. Market participants are closely watching how evolving legal standards may impact NFT valuation frameworks, particularly for blue-chip collections trading on platforms like OpenSea and Coinbase NFT.

GameSquare Holdings Doubles Down on NFTs with $5.15M CryptoPunk Acquisition

GameSquare Holdings (Nasdaq: GAME) made waves in the digital asset space with its $5.15 million purchase of a rare Cowboy Ape CryptoPunk (#5577). The acquisition, funded through convertible preferred shares, marks a strategic shift toward blockchain-native treasury management. The Ape Punk—one of only 24 in the 10,000-piece collection—now anchors the company’s Web3 marketing and yield-generation efforts.

Simultaneously, GameSquare bolstered its ETH reserves with a $10 million purchase, bringing its total holdings to 12,913 ETH ($48.5M). The firm aims to generate 6–14% yields through a diversified strategy combining NFTs, ETH, and stablecoins. Shares closed flat at $1.27 but gained 0.76% in after-hours trading, reflecting cautious optimism about the crypto pivot.

GameSquare Makes Strategic $5.15M NFT Purchase from DeFi Pioneer Robert Leshner

GameSquare Holdings Inc. has entered the digital assets arena with a bold $5.15 million acquisition of CryptoPunk #5577, the rare "Cowboy Ape" NFT, from Compound founder Robert Leshner. The purchase was financed through preferred stock convertible into 3.4 million shares at $1.50 per share, marking the company's first direct NFT investment.

The move signals GameSquare's strategic pivot toward on-chain finance, complementing its recent $10 million ETH treasury addition that brings total Ethereum holdings to $52 million. "This isn't just an asset acquisition—it's a statement about digital identity and decentralized ownership," said CEO Justin Kenna, positioning the 1-of-24 Ape Punk as both financial instrument and corporate symbol.

Leshner, who originally acquired the NFT in February 2022, expressed surprise at its evolution into the face of a public company's crypto strategy. The transaction underscores growing institutional interest in blue-chip NFTs as alternative treasury assets, particularly among firms bridging gaming and blockchain ecosystems.

Why 'Expensive' Ethereum Will Dominate Institutional DeFi

Ethereum's perceived weaknesses—high transaction fees and slower speeds—are becoming its institutional strengths. While retail users migrate to cheaper layer-2 alternatives, financial institutions are doubling down on Ethereum for high-value settlements. The blockchain’s security and reliability justify its premium, mirroring traditional finance’s preference for established systems like NYSE and SWIFT over cheaper, riskier options.

A $500 million interest rate swap isn’t settled on a meme coin chain. Institutions prioritize certainty over cost, paying Ethereum’s fees as a negligible trade-off for ironclad execution. This divergence between retail and institutional needs underscores Ethereum’s growing role as the backbone of regulated DeFi activity.

Ether Surges 4% as BitMine Accelerates Treasury Strategy with $2B ETH Holdings

Ether extended its rally Thursday, climbing 4% after BitMine Immersion Technologies revealed its holdings surpassed $2 billion. The Nasdaq-listed firm acquired 566,776 ETH at an average price of $3,643.75, marking rapid progress toward its goal of controlling 5% of circulating supply.

"We surpassed $2 billion in ETH holdings just sixteen days after closing our private placement," said Chairman Tom Lee, who also heads research at Fundstrat. The company's strategy combines direct accumulation, staking for yield, and creative financing to maximize balance sheet growth.

CEO Jonathan Bates emphasized growing ETH-per-share performance through staking income and active treasury management. BitMine's asset-light approach leverages both internal cash flow and external capital while maintaining flexibility.

The news comes as equity options for BitMine's Nasdaq-listed shares began trading on the NYSE Options Market, signaling growing institutional interest in crypto-focused public companies.

Is ETH a good investment?

Ethereum presents a compelling investment case based on three factors:

| Metric | Current Value | Implication |

|---|---|---|

| Price/20MA | +14.7% premium | Bullish momentum intact |

| MACD Histogram | -65.6184 | Bearish but improving |

| Bollinger Position | Upper band test | Volatility expansion likely |

Ava concludes: 'ETH's technicals suggest short-term consolidation before potential upside. The $3,238 support level must hold - a break below would invalidate the bullish thesis. Long-term investors should dollar-cost average given Ethereum's institutional adoption trajectory.'

Accumulate on dips above $3,500 with a 12-month target of $5,200